Where is the Gemini Legal & Regulatory Staff? ARK's Pictures of A Bitcoin Bottoming

Bits of Signum | 1.13.23

We wish everyone a great MLK Weekend! We had to get a Bits out on an important crypto regulatory topic that we have spent many years contemplating as Lead Advisor to the Web3 Foundation on the launch of Polkadot. Our hope is that the events of this week (and prior weeks) will push the crypto markets to contemplate decentralization faster. See Web3 Foundation’s blog post on Polkadot’s work with the SEC over the last three years.

So, what happened? FTX aftershocks continued with a very public shouting match on Twitter between Gemini’s Cameron Winklevoss and DCG’s Barry Silbert. The conflict stemmed from the inability of Gemini’s ~340,000 customers to withdraw funds from Gemini Earn since November. The way we would summarize the week - Gemini played the good guys, painting Genesis and DCG as the bad guys, while the SEC said, ‘None of this is allowed under US federal securities laws, as laid out in the warning to Coinbase 16 months ago!’

It is important to note the timing of events -

Gemini Earn was an interest-generating / yield service - the customer relationship was with Gemini. Gemini loaned the customer funds to DGC-owned Genesis Global Capital, to generate up to 8.05% in yield, by entering an agreement in Dec. 2020. Genesis opened the service up to depositors in February of 2021. Genesis has halted withdrawals for Gemini’s 340k customers since November. Total assets at time of termination are estimated at $900M.

Coinbase’s Lend program was warned by the SEC on September 1, 2021, through a Wells notice, that they could expect to be sued based on the premise that Coinbase Lend, a similar product to Gemini Earn, was an unregistered security. The product was never launched. This notice occurred 16 months ago.

Yesterday, the SEC charged both Genesis Global Capital and Gemini for offering unregistered securities and failure to make basic disclosures to customers. It is surprising to hear arguments of, “there is no clarity from the SEC” when, 16 months ago, precedent was set with the Wells notice to Gemini’s closest comp, Coinbase. The second allegation in the charge from the SEC was that Gemini Earn bypassed “disclosure requirements designed to protect investors.” In fact, Gemini facilitated the transactions and took up to 4.29% of profits earned by their customers, even though they allegedly didn’t disclose this. If this is true, it is simply mind boggling that Gemini is playing the good guys at the same time that they did not disclose a 429 basis point fee to customers for a yield product, which is no different to an end customer than any other yield bearing product.

All in, couldn’t it have been the case that Coinbase received a gift from the SEC, in that they only received a warning of their non-compliance with US federal securities laws? And then normally, wouldn’t competitors’ legal teams view this warning as fair notice that their own products were infringing on US federal securities laws? In fact, hasn’t Gemini had an unfair advantage for the last 16 months, compared to other entities who followed US federal securities laws? Perhaps this is how they collected $900 million of customer funds?

We thought that SEC Commissioner Jaime Lizarraga’s speech at Brooklyn Law School on November 16, 2022 was especially articulate. Important excerpts -

Contrary to the narrative that the digital asset market offers decentralization, there are high levels of centralization in the ecosystem. Many digital asset platforms offer a wide gamut of services, such as trading, custody, maintaining order books, market-making, and borrowing and lending.

There is significant lack of transparency in the digital asset market. According to FSOC, disclosures by digital asset promoters and issuers lack uniformity and vary widely in the amount of information provided to the public.

It bears noting that it is not the SEC’s responsibility to provide legal advice or analysis to any market participants under its purview. That applies in equal measure, in my view, to those operating in the digital asset market. In light of this, it falls on the issuer or the intermediary and their legal counsel to determine whether their products, business practices, or assets require compliance with the federal securities laws.

Some have suggested that the SEC has not provided guidance to the industry. The reality is that there’s an abundance of guidance, from the DAO Report, to the SEC FinHub Framework for “Investment Contract” Analysis of Digital Assets, and multiple no-action letters issued by the staff of the Division of Corporation Finance.

Decades of legal precedent on what constitutes an “investment contract” or “note” under our securities laws also provides ample guidance to the industry, as well as the sophisticated securities law bar. It’s not a matter of a lack of guidance but more that the existing guidance may not be what many market participants want to hear.

Which harkens the words of Upton Sinclair -

“It is difficult to get a man to understand something, when his salary depends on his not understanding it.”

Industry Stats - New Addition to Bits of Signum

Job Losses:

According to CoinDesk, January 13th brings the running list of crypto layoffs to over 29,000. This week, Coinbase, SuperRare, ConsenSys, and Crypto.com each had layoffs ranging between ~10-30%. Since July, the average layoff size has been ~30% of a Web3 company’s workforce.

Trademark Applications across Digital, Cryptocurrencies, NFTs, and Metaverse:

Data gathered from the United States Patent and Trademark Office (USPTO) by Kondoudis Law shows the number of trademark applications per month on or including digital content (gaming and virtual goods), crypto, NFTs, and the metaverse rose greatly from January ‘22 to March, but has seen declines to new yearly lows in December.

Despite declines in frequency, there is continued interest in Virtual goods and “NFT-backed media” across every industry. Some examples include beverage companies Malibu and Absolut, transportation companies Vespa, Mercedes, and BMW, clothing/lifestyle/sports brands Reebok and Dick’s Sporting Goods, National Geographic, Ticketmaster and even institutions like University of Alabama.

Marketplace Volume Stats

Data provider Kaiko shed light on Binance’s relative growth from 2020 to 2022. In the two year timespan, Huobi and OKX saw 18% and 12% declines respectively, Coinbase grew by 2%, Uniswap by 3%, and Binance by a whopping 20%. On another note, Uniswap just reported their market depth of ETH/USDC vs. Coinbase’s ETH/USD is greater by ~$25M.

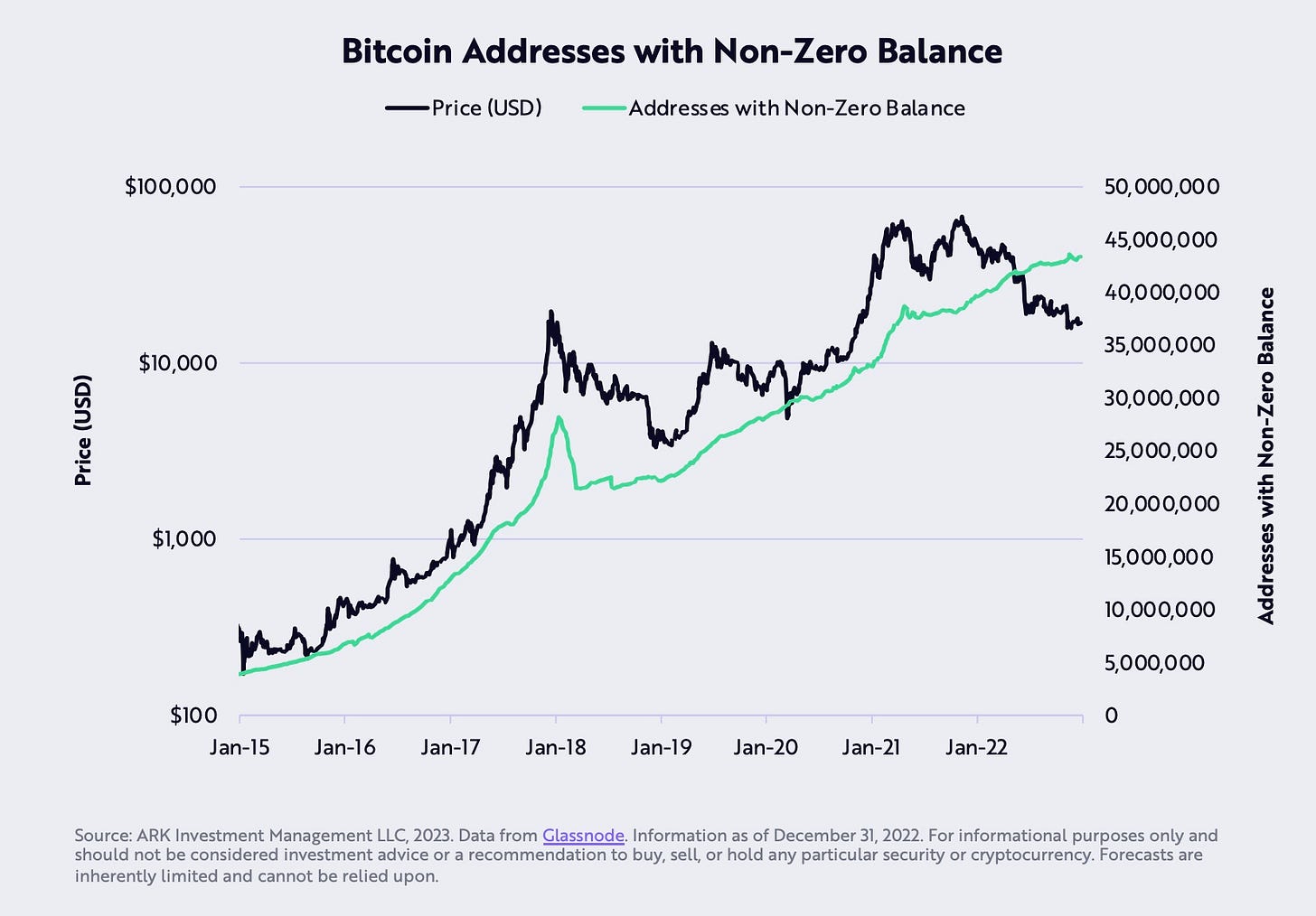

ARK's Pictures of A Bitcoin Bottoming

Speaking of decentralization, see ARK Invest's Bitcoin Monthly by Yassine Elmandjra, David Puell and Frank Downing. Despite the cacophony of centralized crypto headlines, decentralized crypo appears to us to be bottoming. David Puells's tweet lays out a pictures-speak-louder-that-words series on Bitcoin. Here is the first; we would strongly suggest checking out the entire report!